Discover Reliable Financing Providers for All Your Financial Demands

In browsing the vast landscape of monetary solutions, locating trustworthy car loan providers that cater to your details needs can be a complicated job. Let's discover some vital elements to consider when looking for out car loan solutions that are not just reputable yet also tailored to satisfy your one-of-a-kind monetary needs.

Kinds Of Individual Fundings

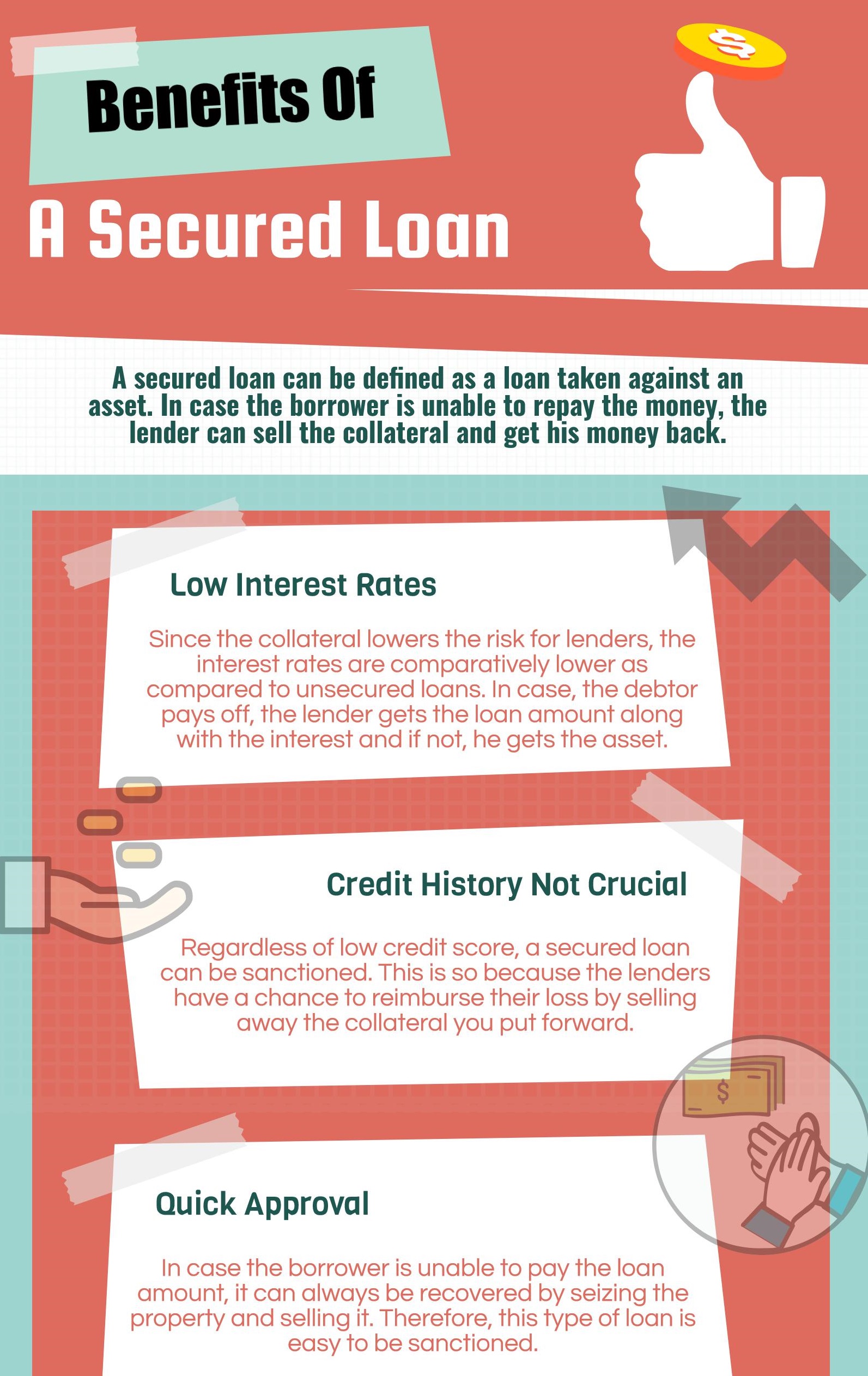

When taking into consideration individual financings, people can select from various types tailored to meet their details economic needs. One usual type is the unsecured personal financing, which does not require collateral and is based upon the debtor's creditworthiness. These car loans normally have higher passion prices because of the enhanced danger for the loan provider. On the other hand, safeguarded individual lendings are backed by collateral, such as a vehicle or savings account, causing lower rate of interest as the lending institution has a form of protection. For people looking to consolidate high-interest financial debts, a financial debt combination car loan is a feasible alternative. This kind of financing incorporates numerous debts into a solitary monthly settlement, often with a reduced rates of interest. Furthermore, individuals looking for funds for home improvements or major acquisitions may choose for a home improvement finance. These lendings are especially designed to cover costs connected to improving one's home and can be protected or unsafe relying on the lending institution's terms.

Advantages of Online Lenders

Understanding Lending Institution Options

Credit score unions are not-for-profit economic cooperatives that use a range of products and solutions comparable to those of financial institutions, including cost savings and examining accounts, lendings, debt cards, and more. This possession structure typically converts right into reduced fees, competitive passion prices on lendings and cost savings accounts, and a strong focus on consumer solution.

Cooperative credit union can be attracting people looking for a more individualized technique to financial, as they commonly focus on participant fulfillment over profits. Furthermore, lending institution frequently have a strong area visibility and might supply monetary education and learning resources to help members enhance their monetary literacy. By understanding the alternatives offered at lending institution, individuals can make informed decisions about where to entrust their monetary needs.

Exploring Peer-to-Peer Borrowing

One of the key destinations of peer-to-peer financing is the potential for reduced rate of interest prices compared to typical monetary establishments, making it an enticing option for debtors. Additionally, the application process for getting a peer-to-peer loan is commonly streamlined and can result in faster accessibility to funds.

Investors likewise gain from peer-to-peer borrowing by potentially making greater returns compared to conventional investment alternatives. By removing the middleman, financiers can straight money borrowers and get a section of the rate of interest settlements. However, it is necessary to keep in mind that like any investment, peer-to-peer loaning lugs inherent risks, such as the opportunity of borrowers back-pedaling their lendings.

Entitlement Program Programs

In the middle of the developing landscape of monetary services, a vital aspect to think about is the world of Entitlement program Programs. These programs play a critical duty in giving financial assistance and support to people and organizations throughout times of demand. From welfare to small business loans, government aid programs aim to ease monetary concerns and promote financial stability.

One popular example of a federal government aid program is the Small Service Administration (SBA) loans. These car loans offer favorable terms and low-interest prices to assist local business grow and navigate obstacles - mca funding companies. Furthermore, programs like the Supplemental Nourishment Support Program (SNAP) and Temporary Assistance for Needy Families (TANF) offer necessary support for people and households dealing with economic difficulty

Additionally, entitlement program programs extend beyond financial assistance, including real estate support, medical care aids, and academic gives. These initiatives intend to resolve systemic inequalities, advertise social welfare, and make sure that all residents have access to fundamental requirements and chances for improvement. By leveraging federal government aid programs, people and services can weather economic storms and aim towards a more safe monetary future.

Verdict

Comments on “Accomplish Your Desires with the Assistance of Loan Service Experts”